The best bank in Bahrain … is Meem

Yes, that’s right. The best bank in Bahrain is … Meem. This nomination will be especially shocking to those of you that read my last post that ripped the Meem app to shreds.

Criteria for ‘best bank’

My criteria for “best bank” isn’t the best user experience or customer support. It’s all about the best bank for buck.

There are two main parts to this:

- What’s the best cashback rate I can get back on my spending?

- What’s the best profit rate I can get back on my deposits?

While I always limit myself to shariah-compliant options, you’ll soon see that the rates Meem offer are actually superior to even the non-compliant options in Bahrain.

Cashback 💳

I’m always befuddled when I’m standing in line at the cashier and see the person in front of me whip out a debit card. Why on earth are you paying with a debit card?? Paying with a credit card that has Cashback is literally free money (assuming, of course, that you pay the bill in full at the end of each month).

Here are the cashback rates for the Meem credit card[1]:

- 1% cashback for spending below BD 500 a month

- 2% cashback for spending between BD 500 — BD 1000 a month

- 3% cashback for spending above BD 1000 a month (capped at BD 50)

Take a second here to recognize how insanely good these rates are! Not just at the local or regional level … even globally. You’d have a hard time finding a card that offers more than 2% cashback in the US; see for yourself[2].

As for Bahrain, no bank even comes close.

Here are the cashback rates for a sample of popular Bahrain banks:

- Ithmaar Bank — 0.2%

- NBB — 0%

- Credimax — 0% on local purchases; 1% on international

Not. Even. Close.

I hit the 3% rate consistently with Meem (since I use my card for paying alot of my online business bills), and this means BD 50 of free money each month, or BD 600/yr. Nuts!

Return on deposits 💰

These are typically known in the industry as “fixed-term deposits” (or Fixed Deposits). This means locking up your money for a fixed period between 1 month and 1 year, with a guaranteed rate of return (always quoted per year, regardless of the term you pick).

While fixed deposits are not Sharia compliant, Murabaha is — a variant where you purchase something from the bank (usually a commodity, like cement) and sell it back for a profit at the end of the term.

Once again, the rates Meem offer are higher than anything I’ve seen offered by any other bank in Bahrain. Fixed deposits are tricky to compare since the rates change during the year (with the change in the base rate by the CBB), and they also vary by currency.

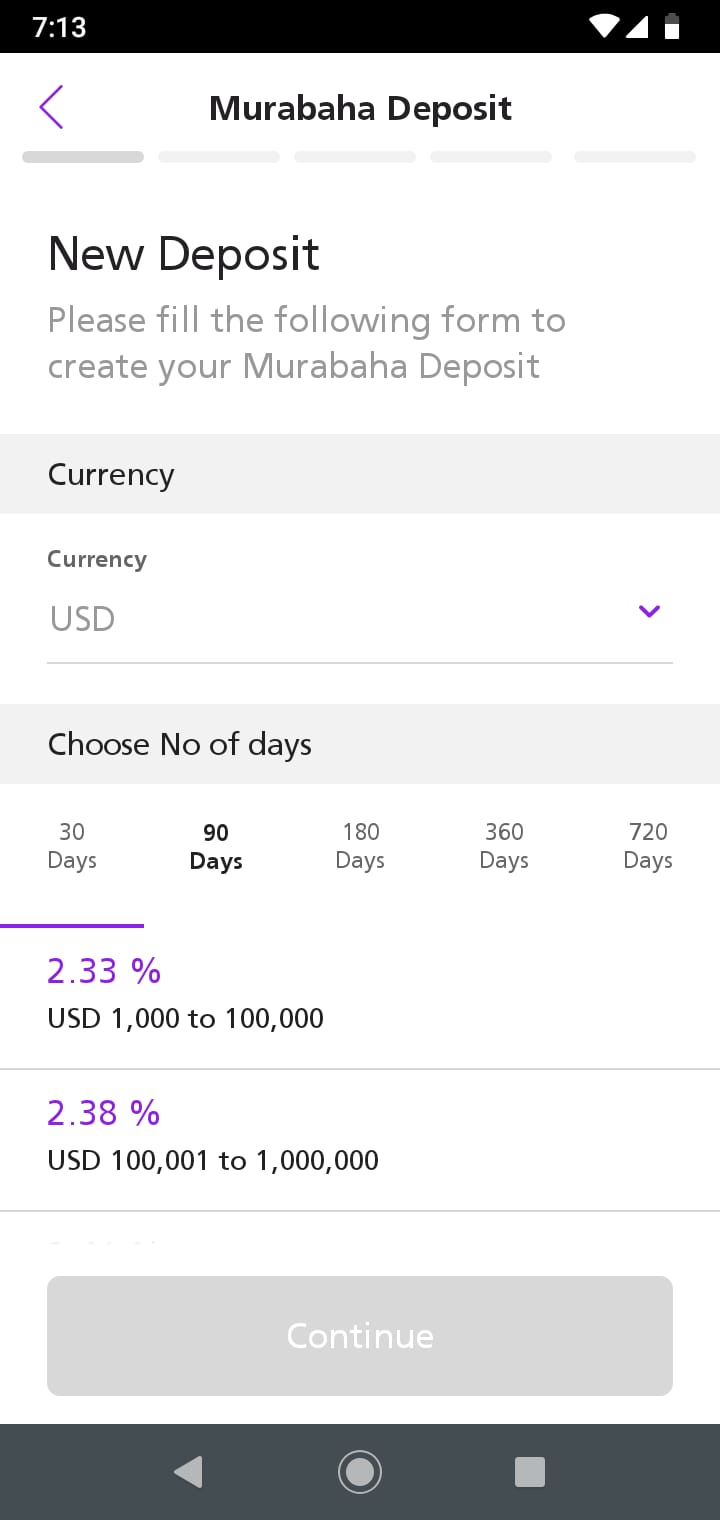

Here are the rates for Meem in January, 2020[3]:

- 2.33% on USD (90 day term) — no minimum

- 1.17% on BHD (90 day term) — no minimum

Obviously, huge difference between BHD and USD — and so you’re better off converting to USD when you deposit. Meem makes this easy by offering multicurrency accounts (the BHD/USD rate is capped by the CBB; Meem provides a significantly better rate of 0.3765 BHD/USD vs the 0.375 BHD/USD that most banks in Bahrain provide).

So, 2.33% for Meem. Let’s compare to a few other banks in Bahrain, shall we:

UPDATE: A friend tipped me off to Jazeel, a Digital Bank launched by KFH, that offers Wakala rates that match Meem’s USD rates but for BHD[4]. Details:

- KFH Jazeel: 2.3% BHD (90 day terms) — BD1000 min.

If you can meet the BD 1,000 minimum then they’d be a better option for BHD deposits than Meem’s.

I’m unable to provide more links to banks in Bahrain, because they don’t share the rates online. To my knowledge, the rates are less competitive than those of KFH cited above (and Meem, of course). If you’ve got more numbers for me to include, please let me know.

Conclusion

Using Meem’s financial products can earn you:

- BD 600 / year in cashback

- BD 23 / year for every BD 1,000 you deposit (on a USD denominated Murabaha deposit @ a 90 day term)

That’s better than every other bank in Bahrain I’ve come across, and they are Sharia compliant.

There you go, folks — you’re welcome! Share this post around if you found it useful.

👣 Footnotes

[1] Meem isn’t very forthcoming on their website about the cashback rate, simply saying that they offer “up to 3% cashback” on credit card purchases. Their app provides the breakdown that I shared.

[2] Any rates over 2% are usually guarded with multiple qualifiers limiting their utility specifying either merchants or a specific category that is included, and always capped at a very low yearly amount.

[3] Not shared on their website, but available in the app. Screenshots below:

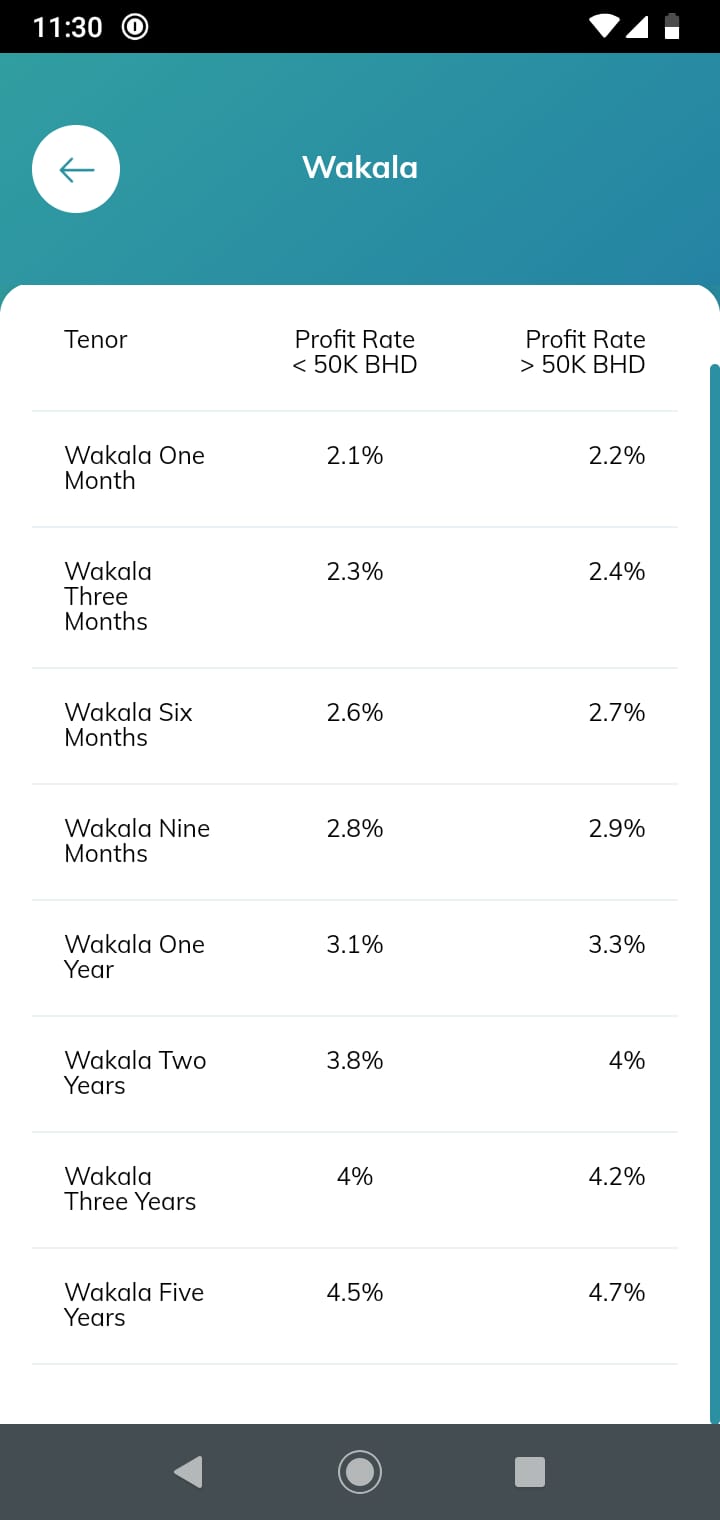

[4] Not shared on their website, but available in the app. Screenshots below: