How I Invest

In this post, I’ll discuss how I invest my money - even small amounts - so I can stand a reasonable chance of attaining an average return (of roughly 7%/year).

The keyword here is how.

I won’t be discussing investing strategies. Instead I cover the actual mechanics involved that an average person in the Middle East (who isn’t a US citizen/resident) can follow to put their money to work in a Sharia compliant manner[1].

I struggled to figure out all of this stuff for myself — partly because investing is meshed with so many peripeheral concepts and new lingo that the whole thing can get very overwhelming. a lot of the material out there just doesn’t apply. It usually assumes you’re a US citizen with special tax-efficient investing accounts or whatever. Also, you’d be hard pressed to find any material that addresses Sharia compliance.

So with all that said, let’s dive right in.

Background

I grew up not knowing much about investing. Up until very recently, I thought gold was “it”. Sure, if I were in the US and had an IRA account or whatever, I’d have a much broader range of investment opportunities. But I wasn’t, and so that’s that.

Turns out, I couldn’t have been more wrong.

All those years ago, all those wasted opportunities to invest a few thousand here and there could have brought about some serious returns. But I wasted them. Not only that, but I just kept my extra money in a bank account, where inflation just ate away at it. Sure, it says the same amount everytime I check in, but in reality — it buys you less and less “actual stuff” with every passing year. You lose, just without you noticing.

Anyway, there’s no use crying over spilled milk. The best time to invest is when you make your first buck. The next best time is RIGHT NOW.

Strategy

The strategy I’m using as a reference is the one described in the world-renowned The Intelligent Investor published in 1949 that Warren Buffet swears by.

Namely,

- 50% stocks (considered higher risk, higher return investment)

- 50% bonds (considered lower risk, lower return investments)

If you’re interested in learning more, The Intelligent Investor is for you. I’m thinking of writing a follow up post that dives into strategies, so let me know if that’s something you’re interested in reading.

Part 1 - Stocks

I always thought that you couldn’t get access to US stocks without having a Social Security Number. Turns out, it’s not necessary. In fact, one of the largest brokers in the world allows investors from all over the world to join freely. Sure, you’d still have to wire money to the US — but you do NOT have to be a US citizen.

To start, all I had to do was open an account with InteractiveBrokers and complete the KYC process (Full disclosure: This is a referral link that earns you a free stock worth up to $1,000 on sign up).

I was tempted to buy individual stocks like Apple, Google or Facebook and you may be too: DON’T. Coming back to the core strategy, we’ll stick to buying index funds instead — which is like a buffet that includes all of the stocks in a market that match a certain criteria. The criteria typically only includes large companies (e.g. the US S&P500 is the largest US companies by market cap), but we can also filter out companies that are not Sharia compliant.

Luckily, I found a few index funds that have already done the hard work of filtering out non-compliant stocks:

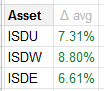

- ISDU - iShares MSCI USA Islamic UCITS ETF - USD

- ISDW - iShares MSCI World Islamic UCITS ETF - USD

- ISDE - iShares MSCI EM Islamic UCITS ETF - USD

They’re broken down by geography: US, World and Emerging Markets (EM). The actual split between the regions is another element of the strategy that you can decide to follow. I’m experimenting with 45% US, 25% World and 35% EM.

So if I’m investing $1,000 I would split it up like so:

- $450 of ISDU

- $250 of ISDW

- $350 of ISDE

That would automatically give me exposure to the largest Sharia compliant companies in the US, Emerging Markets and the World.

Important Note: Despite the fact that I’m investing in various geographies, there’s still a significant degree of correlation between them. That’s why it’s important to make sure that you’re not keeping an all stock portfolio.

With that, let’s talk bonds.

Part 2 - Bonds

Revised, 2020: The low interest rates globally (due in some part to COVID19) means that the yields on bonds are incredibly low, and could drop significantly once rates bounce back up. I have 0% exposure to Sukuk for this reason, and don’t recommend anyone buys them in the near term.

Bonds are loans made to companies or governments, that are paid out over a fixed period of time — and that provide fixed returns to the investors. To be clear, bonds themselves are not Sharia compliant. Instead I picked “Sukuk”, conceptually similar to bonds, but that adhere to Sharia principles.

Here again, the goal is to minimize exposure to any one company — and instead get access to a large swathe of a region.

Sukuk are actually much harder to find indices for. I found the below, but it’s unfortunately not listed on the InteractiveBrokers platform:

Instead, you’d need to get access to them through your local bank. I’ve included some examples below:

In my native Bahrain, the Franklin Global Sukuk Fund is accessible via the following banks:

- Ahli United Bank

- Standard Chartered

- Citibank

I’ve reached out to them to compare the fees associated with an investment via each of them, and will share them once I hear back.

Starting off…

There’s an important point I haven’t yet addressed: given the current negative outlook on stocks & bonds, I did NOT want to jump all in to the market. But what do you do then? No one knows how the stock market will react, and it is generally better to start investing sooner rather than later.

The answer turned out to be simple; so simple in fact, that it is just 3 letters long: DCA. Dollar Cost Averaging.

Rather than attempting to predict when the market will dip so you can charge in, just investment smaller amounts over a longer period of time. This will average out the impact of the market — while still leaving me with the oppportunity to invest more as the market drops.

In practice, you’d want to use a bank transfer service that minimizes individual transfer fees, so you’re not paying several %’s of each transfer on bank fees. HSBC Premier actually allows for free transfers to the US — though I don’t know if this applies to their lower tier Advance/Standard accounts. (Again to keep everything Sharia compliant, make sure to request a non-interest bearing account).

Cost & Fees

I suggested InteractiveBrokers as the de facto solution because they are the most fee-efficient way I was able to find IF you are investing significant amounts of money.

How significant?

Well, they require that you pay at least $15/month in fees (a purchase of any of the 3 funds I mention above costs $5). Your minimum total yearly fee would end up being $15 x 12 = $180. You want to be investing $18,000+ for that to represent < 1% of your total.

If you’re investing less, there are some other potentially cheaper alternatives (which end up being around 1%/yr each):

- Wahed Invest which offers a Sharia compliant solution that covers both stocks and sukuk

- Sarwa — which recently started offering a Halal portfolio similar to the one I describe above, but without the Sukuk.

- Haseed (Coming soon)

Returns

I will share my results here as time progresses, allowing you to see how this strategy works over the long run.

Returns at 6 month mark: +7.13%

[1] As a Muslim, I consider Sharia compliance a necessary quality in any investment I make. At a high level, this means avoiding business lines considered ethically or morally unsound (alcohol, adult entertainment for e.g.), as well as interest-bearing businesses.